Best Buckets To Help Budget

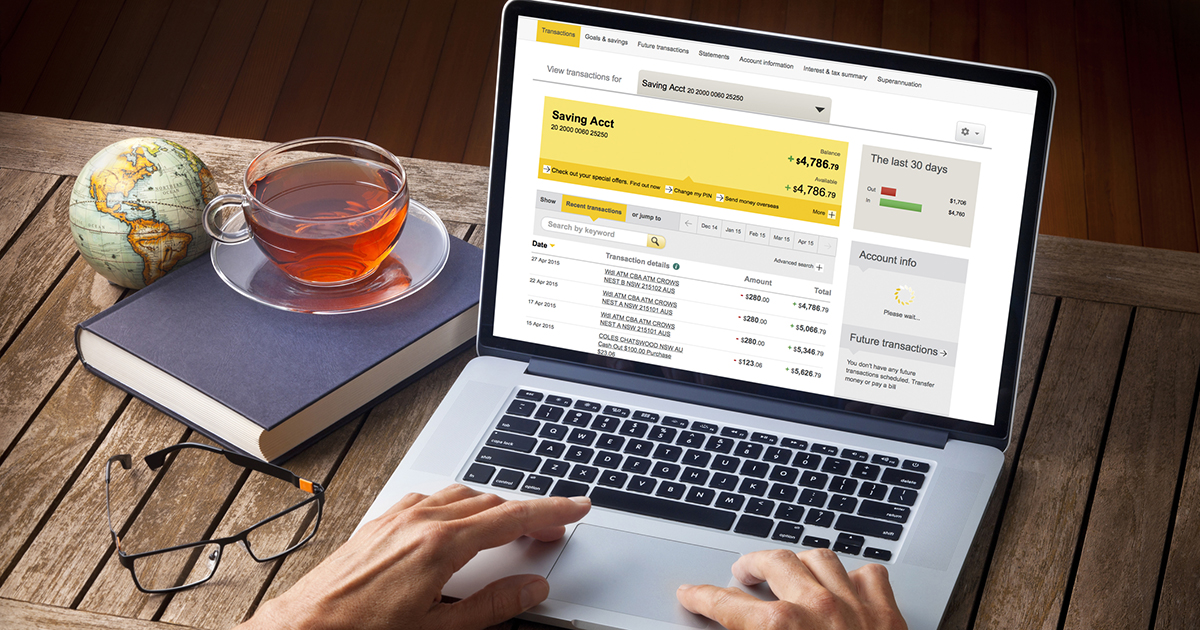

Savings Account

Did you know you’re meant to pay yourself first? Before you pay your monthly bills, you should put money into your savings account. The best way to start this is to find out how much you make and how much you owe and compare that to what is left over. Now you should save at least ten percent of your total income where possible. If it’s not possible, try starting lower and saving ten percent of what you have left over after you account for your bills. Put the money into your savings bucket each month before you pay for anything else. You only get to spend what is left over following a deposit into your savings account and into your other expense buckets. If you get a raise at work, put all the money from your raise immediately into savings. If you get a check in the mail for something you overpaid throughout the year, put it into your savings. You want to see your savings bucket grow as fast and as much as possible without making much effort at all. You want more money in the bank than you put out every month.

Continue reading to learn about emergency funds under this method.