5 Types Of Retirement Income And How They're Taxed

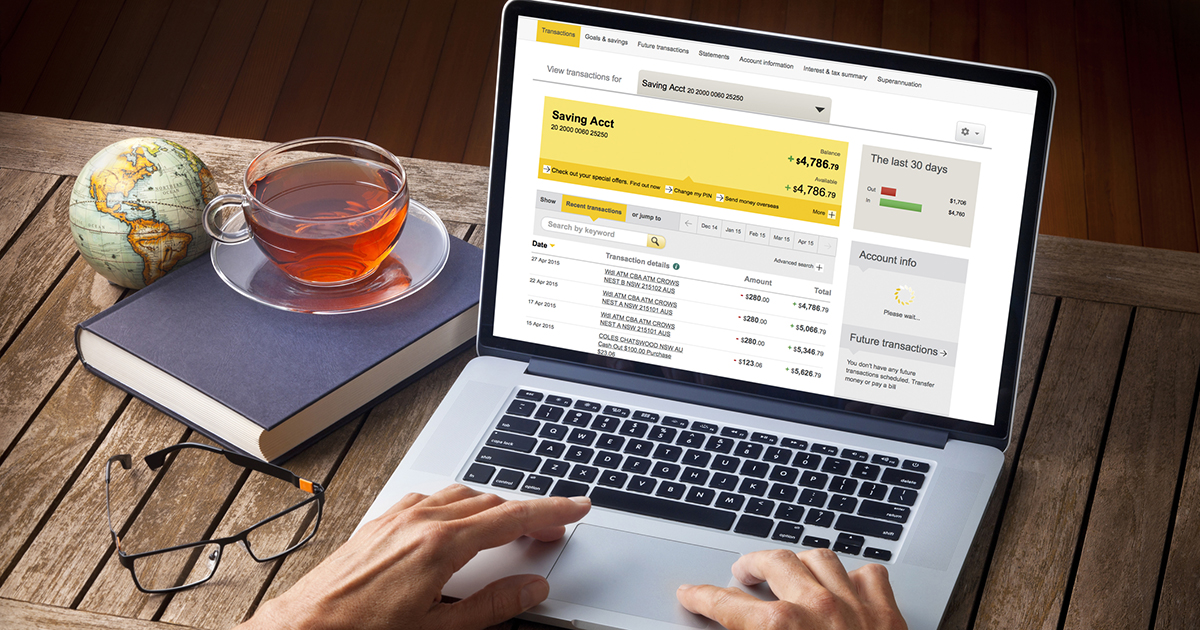

Savings And Money Market Accounts

Savings accounts receive very small amounts of interest while money market accounts can offer a higher rate that is variable depending on the economic climate at the time. This is a popular retirement savings vehicle, however, because there are very few associated risks like there are with stocks and other investments. The cutoff for the amount of interest that must be earned to be considered for taxation is ten dollars. If the total interest in an account is less than this figure, you will not receive a form 1099-INT and do not have to include this on your annual income taxes. If you earn more than ten dollars in interest from a savings or money market account, you will be taxed at your particular income tax rate. If the bank or financial institution paying you interest does not provide a 1099-INT, be sure to ask for one before filing your taxes each year.