Simple Ways To Boost Credit Score

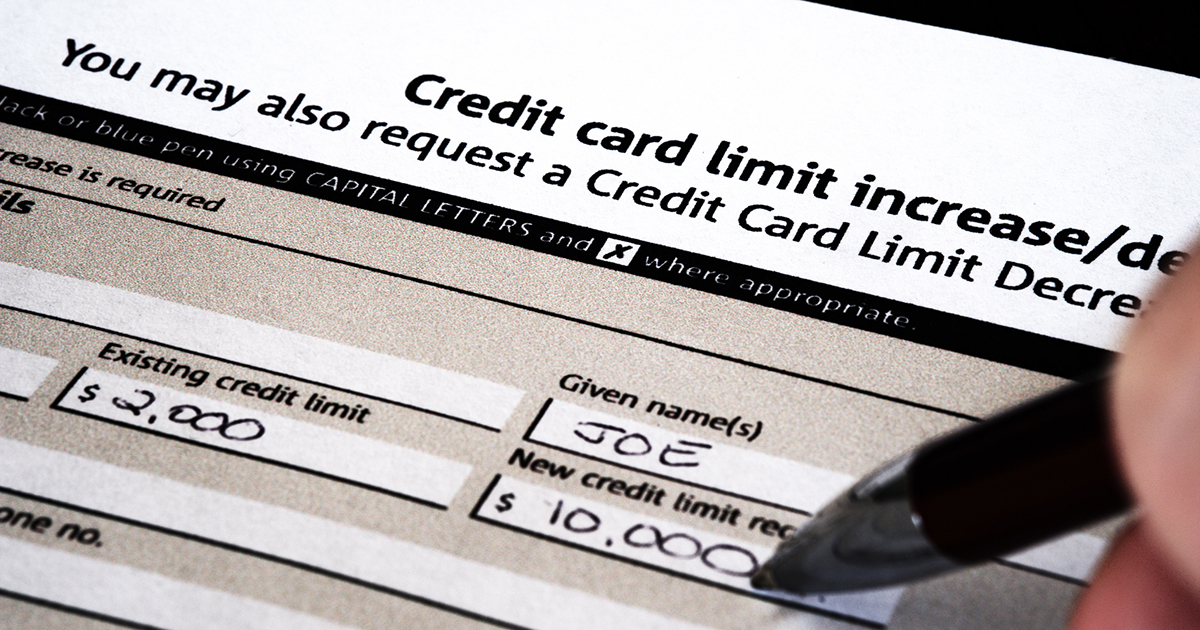

Increase Credit Limit

You don’t want to max out your available credit, but you should increase credit limits when presented with the opportunity. The more available credit you have, the lower your credit utilization score. Your credit score is determined using a variety of factors, one of which is credit utilization.

Let’s say your total available credit is ten thousand dollars and you have one card with a five thousand dollar balance you’re slowly paying off. You are using half of your available credit, which doesn’t look good. It’s favorable to carry no balance, but you should keep any balance you carry below thirty percent if you don’t pay it off. If you have the opportunity to increase your available credit to fifteen thousand dollars, you automatically drop your credit utilization ratio to thirty percent. You’ve just boosted your credit score without doing anything other than accepting a higher credit limit.